Mortgage Rates For February 14, 2024: What are Closing Costs When You Buy a Home?

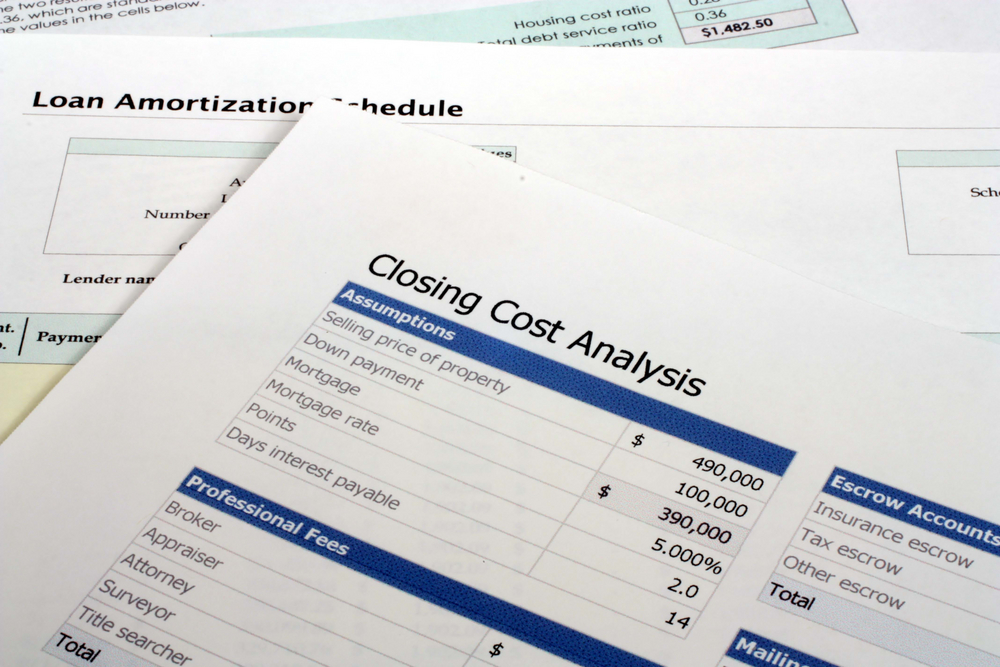

When you purchase a home, there are various fees and expenses you’ll have to cover in addition to the cost of the home itself. You may wish to consider this when looking at average daily mortgage interest rates and the total amount of loan you need, versus the amount you’ve saved as a down payment on a home.

Closing costs go to your lender. They’re administrative processing fees to cover the cost of closing on your home. This covers the labor it requires to handle the paperwork. Closing costs are standard and are not scams. If you’re concerned about the closing costs, be sure to consult your real estate agent and conveyancer, who may take a look at your loan contract for you.

Today’s 30-year mortgage interest rates

The average daily mortgage interest rate for Friday, February 9, 2024 is 6.75% for a 30 year fixed rate. The rate fell 0.04% from yesterday and have risen 0.40% from December 2023. This information is sourced daily from correspondent, retail, and wholesale lenders located in the United States.

Today’s 15-year mortgage interest rates

The average daily mortgage interest rate for Friday, February 9, 2024 is 6.01% for a 15 year fixed rate. The rate fell 0.01% from yesterday and have risen 0.54% from December 2023. This information is sourced daily from correspondent, retail, and wholesale lenders located in the United States.

What do you need to know about closing costs when buying a home?

Specifically, your closing costs should spell out what they cover. This can include the loan origination fee, title searches, appraisal fees, taxes, surveys, deed research, recording, and recovery, credit report acquisition, and more. Remember that in addition to these administrative actions, the bank will likely have a lawyer look over your loan documentation. All of this costs money, and it’s on the buyer to pay.

How much are closing costs for the buyer?

Most buyers pay 2-6% of their loan amount in closing costs.

How can you avoid closing costs?

It’s rare, but it depends upon the situation. You can lower closing costs by closing at the end of the month and shopping around for the right loan, as different lenders have different policies and fees.

What does earnest money mean?

Earnest money does not include closing costs, but it’s a good-faith down payment put down to express serious interest in buying the home. Depending on the contract, a buyer’s earnest money may or may not be refundable.

Note that closing costs vary by bank and location. Each state has policies that can affect how much closing costs are in the area. If you’re considering a home purchase in multiple states, ask your real estate agent about the costs associated with one versus the other.